Batch 9

Venture Capital and Private Equity Programme

- Triple Crown Accredited B-School

- Online + Live Sessions, Masterclasses and Office Hours

- Get ISB Executive Alumni Status

- #1 Executive Education Ranking in India (FT 2024)

Round Application Deadline

Upcoming round date: Invalid liquid data | Application Fees:Invalid liquid data

Programme Overview

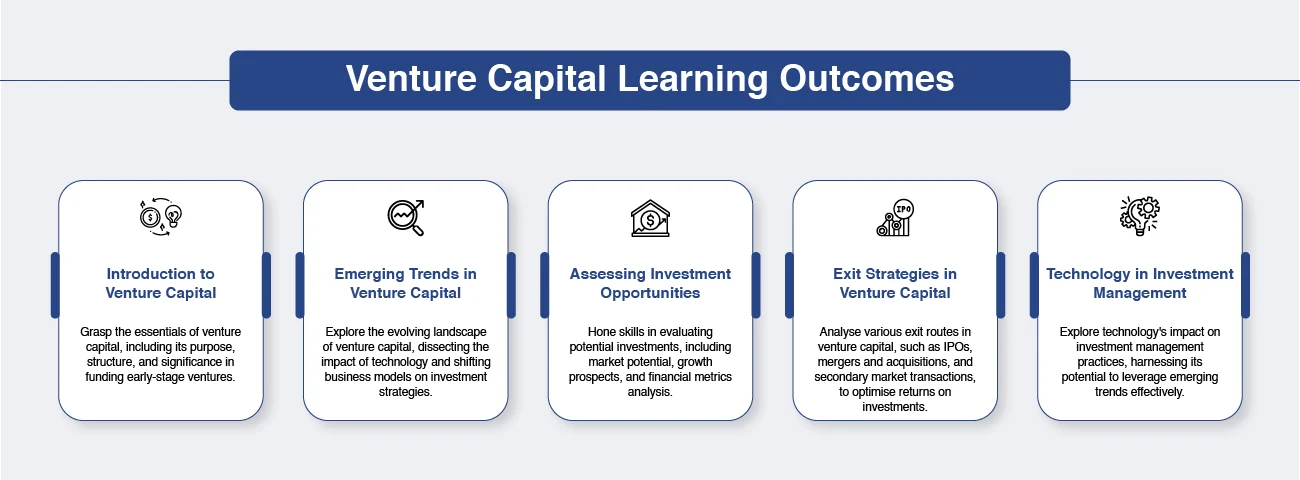

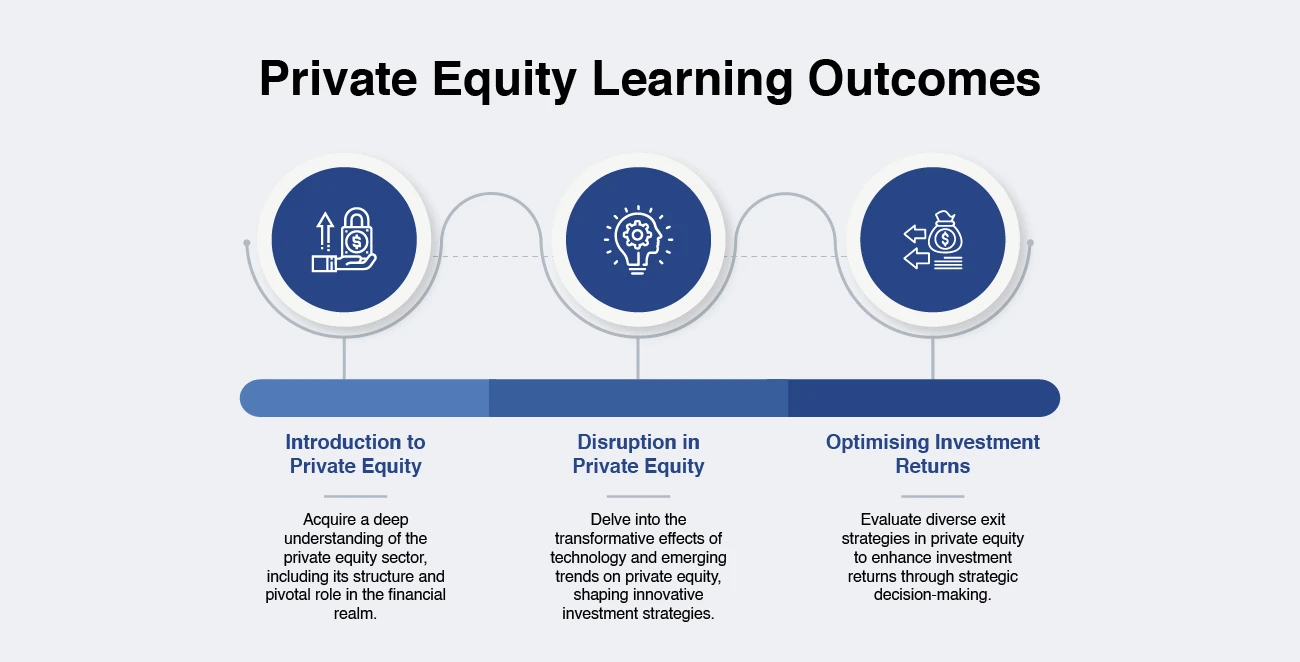

Enroling in the Venture Capital and Private Equity programme by the ISB Executive Education provides a comprehensive foundation in the principles and practices globally. The curriculum is designed to equip professionals with the skills needed to navigate the complexities of the industry, including deal structuring, valuation techniques, and exit strategies.

Upon successfully completing the programme, you will be awarded a certificate from ISB Executive Education.

Programme Highlights

100+ Pre-recorded video lectures* for self-paced learning from renowned ISB faculty

2-3 Live sessions by ISB faculty

6+ Masterclasses by industry experts

1 Capstone project

2 Action learning activities

10+ Networking office hours

Note:

*This is a self-paced online programme with Few Exclusive Live Sessions by ISB Faculty and some masterclasses by industry experts. We have a curated panel of success coaches who will be conducting the weekly live doubt-clearing sessions.

**Assignments are graded either by industry practitioners who are available to support participants in their learning journey and/or by the Emeritus grading team. The final number of quizzes, assignments and discussions will be confirmed closer to the programme start.

Live Webinar with ISB faculty's recordings may or may not be made available, at the discretion of faculty members. Emeritus or the institute does not guarantee availability of any session recordings.

Office hours are weekly live connects with the Programme Leader/Success Coach for query resolution.

Cutting-edge Masterclasses

Mastering Investment Analysis: From Quality Metrics to Market Dynamics

Strategic Insights in Venture Capital: Thematic Investing, Power Laws, and Performance Metrics

Navigating Deal Sourcing: Essential Tools for Venture Capital Success

Alternative Venture Capital: Real-World Examples and Strategies

Comprehensive Equity Strategies: Private, Public, and Global Perspectives

Mastering Private Equity: Metrics, Success Factors, and Avoiding Pitfalls

In-Depth Analysis of SPACs and Deal Syndication: Case Studies and Market Insights

ISB Executive Alumni Benefits

Access to the Executive Alumni portal – a unique space for alumni to re-ignite connections, spark collaborations and engage in continuous learning. The alumni portal has several features like an alumni directory, city chapters, special interest groups, alumni mentorship and more. Access to the alumni portal is provided post the programme completion.

Networking opportunities via ISB Executive Education Network Group on LinkedIn.

Preferential pricing with 20% discount on programme fee on ISB Executive Education programmes.

ISB Executive Education newsletters, articles, podcasts and videos.

Access to ISB Executive Education support team over email.

Exclusive invitations to Online and Offline events like Webinars, Conferences, and Master Classes, amongst others.

Opportunity to be a Guest Speaker at ISB Executive events (invited on the discretion of ISB Executive Education).

ISB Executive Alumni Credentials: ISB Email ID.

Disclaimer: All activities and research resources for ISB Executive Education alumni are handled by ISB Executive Education. Whenever there are any events or webinars held, they will be informing the alumni community of the same. Events take place yearly basis availability of resources & is subject to change.

Who is this Programme for?

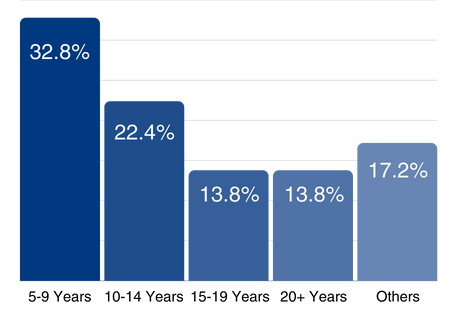

Professionals with 5+ years of work experience who are looking to embark on their journeys in the VC & PE domain and network with like-minded peers.

Professionals looking to take significant strides in the VC & PE sector, who want to gain an understanding of sourcing, managing, and structuring deals.

Note: An updated resume and LinkedIn profile is mandatory for application.

Testimonials

Action Learning Activities

Deal Negotiation

Deal Valuation

Programme Modules

Programme Faculty

Associate Professor, Strategy, Executive Director - SRITNE, Associate Dean - Centre for Learning and Teaching Excellence, ISB

Professor Nandkumar explores industry and firm level phenomena that influence innovation – the generation of new ideas and entrepreneurship – distribution and commercializatio...

Assistant Professor, Strategy, ISB

Professor Sen’s research interests primarily include business model innovations, impact of such innovations on corporate strategy decisions such as strategic alliances and pri...

Visiting Faculty, ISB

Rajeev Mantri is the managing director of Navam Capital, an India-focused venture firm investing in deep technology and frontier technology startups. Prior to founding Navam C...

Visiting Faculty, ISB

Marketing and Strategy Visiting Faculty, ISB Professor Nandkishore is a Global C-suite Executive with over 34 years of global experience in Leadership roles across a diverse s...

VC Circle Membership

1-year subscription to VC Circle Premium:

Exclusive PE/VC Coverage

Handpicked Articles, Trends and Breaking News Coverage

Expert Opinion and Analysis

Concession on Selected VC Circle Event Tickets

Programme Certificate

Upon successfully completing the programme with a minimum 70% score, you will be awarded a certificate in Venture Capital and Private Equity Programme from ISB Executive Education.

Note: All certificate images are for illustrative purposes only and may be subject to change at the discretion of ISB Executive Education.

Student Loan Available

Below EMI plans are available for the Programme Fee: INR 4,61,000 + GST

Max Loan Amount | Tenure (months) | EMI |

|---|---|---|

INR 5,16,781 | 24 | INR 26,054 |

INR 5,16,781 | 36 | INR 19,107 |

INR 5,16,781 | 48 | INR 15,763 |

Also available in 12/18 months EMI plans.

Programme FAQs

Early registrations are encouraged. Join now.

Flexible payment options available.

Starts On